India’s economic landscape has been a beacon of growth, with the Micro, Small, and Medium Enterprises (MSME) sector playing a pivotal role. Recent data reveals a promising trajectory for the MSME sector, which has been instrumental in driving the nation’s commercial credit portfolio. In FY 23-Q4, this portfolio witnessed a robust 15% YoY growth, with the credit exposure reaching a staggering INR 27.7 Lakh Crores.

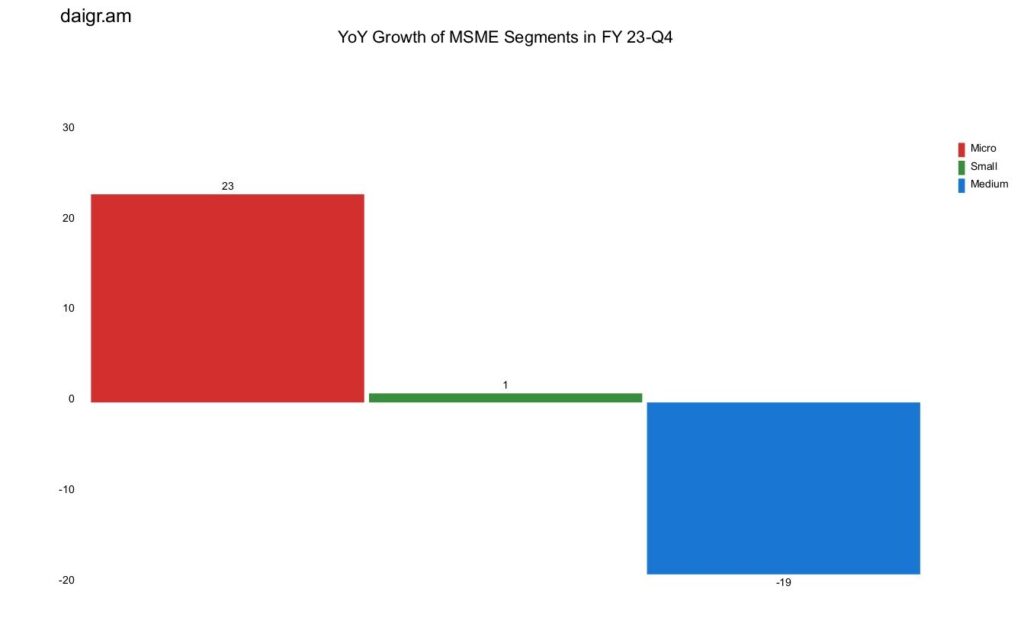

Interestingly, the demand for commercial credit surged by 33% YoY in the same quarter. Diving deeper into the MSME segment, the ‘micro’ category (with a credit exposure of less than INR 1 Crore) showcased a 23% YoY growth in originations value. In contrast, the ‘small’ segment experienced a modest 1% growth, while the ‘medium’ segment faced a 19% decline.

Year-over-Year (YoY) growth of the ‘micro’, ‘small’, and ‘medium’ segments in the MSME sector for FY 23-Q4:

Source – CIBIL TU

Geographic Movement

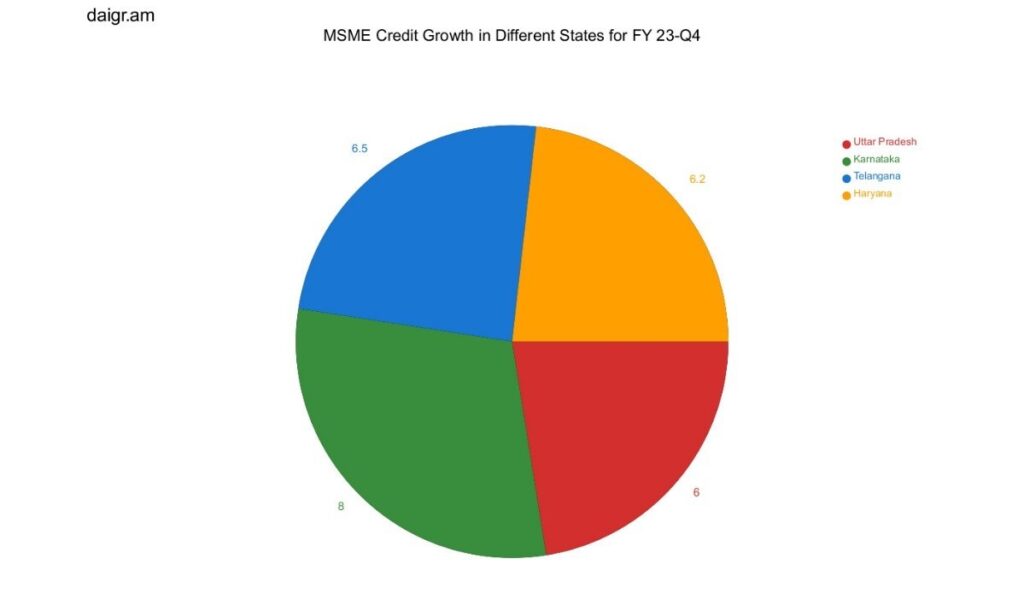

Regionally, states boasting higher industrialization levels, such as Uttar Pradesh, Karnataka, Telangana, and Haryana, have been at the forefront of MSME credit growth. Notably, Karnataka emerged as the top-performer, registering an impressive 8% growth rate.

MSME credit growth across key states for FY 23-Q4:

Source – CIBIL TU

Expected Trends in the MSME Sector

- Continued Growth in the Micro Segment: The ‘micro’ segment has shown a robust 23% YoY growth, indicating a surge in small-scale entrepreneurial activities. This trend is expected to continue, with more individuals venturing into micro-businesses, leveraging digital platforms and government incentives.

- Revival of the Medium Segment: While the ‘medium’ segment witnessed a 19% decline, it’s anticipated that with the right policy interventions and market conditions, there will be a revival. The government might introduce more supportive measures, and businesses could adapt to changing market dynamics.

- Digital Transformation: With the rapid adoption of technology in every sector, MSMEs are likely to further embrace digital solutions. From digital payments to online marketing and e-commerce platforms, technology will play a pivotal role in the growth and expansion of MSMEs.

- Geographical Expansion: While states like Karnataka, Uttar Pradesh, Telangana, and Haryana are currently leading in MSME credit growth, other states might join the bandwagon. Regions with untapped potential might see a surge in MSME activities, driven by local initiatives and investments.

- Sustainable and Green MSMEs: With the global emphasis on sustainability, MSMEs in India might pivot towards eco-friendly business models. This could range from sustainable manufacturing practices to offering green products and services. The green economy might open new avenues for growth in the MSME sector.

Incorporating these trends, businesses, policymakers, and stakeholders can strategize effectively, ensuring the MSME sector’s continued contribution to the Indian economy.