The MSME sector, often hailed as the backbone of the Indian economy, has been buzzing with activity, especially in the credit domain. As we delve into the industry insights for August 2023, a few trends emerge that paint a comprehensive picture of the credit demand, supply, and growth dynamics.

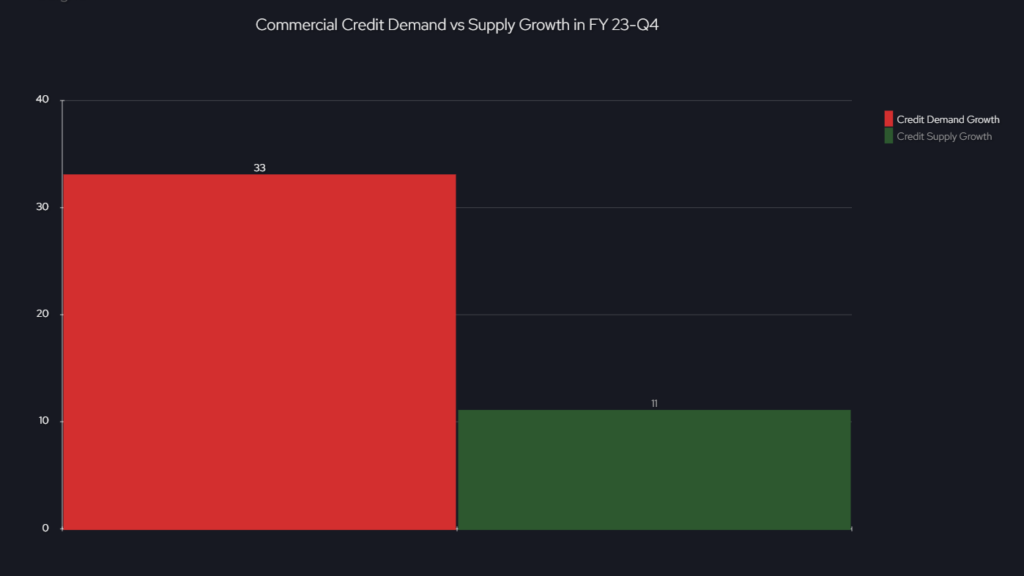

A significant uptick of 33% in commercial credit demand was observed in FY 23-Q4, underscoring the sector’s robust appetite for financial resources. However, a mismatch emerges when we look at the credit supply, which lagged behind, registering a growth of only 11% in the same period. This disparity indicates a potential area of focus for financial institutions.

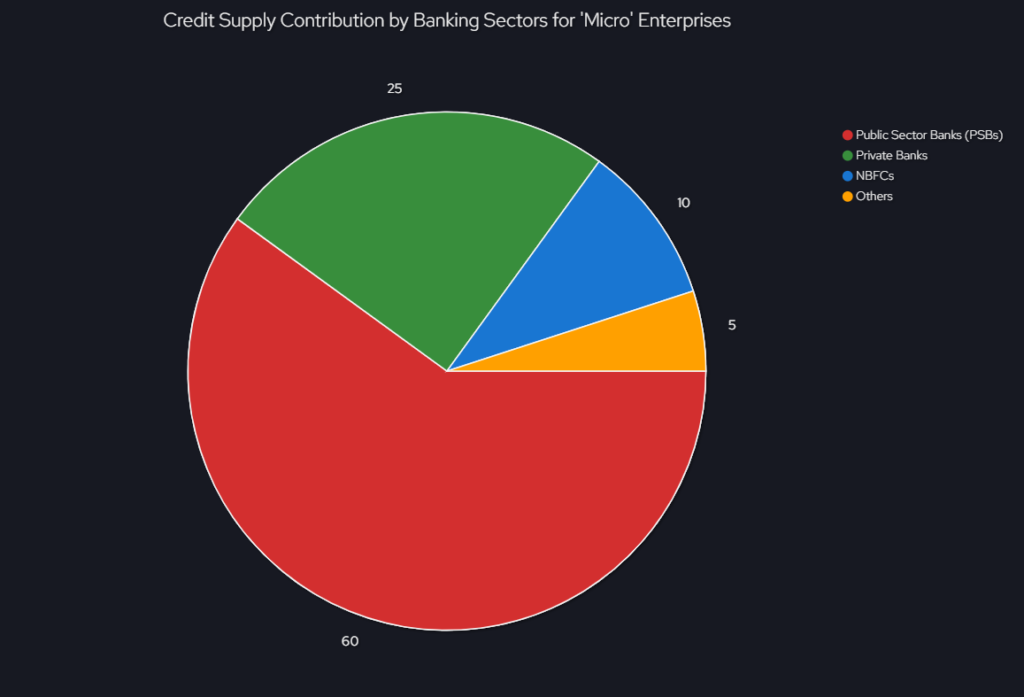

Public Sector Banks (PSBs) have emerged as the champions for the ‘micro’ enterprises, leading the charge in credit supply. On the flip side, the average loan size for commercial loans availed by MSME entities saw a dip in FY 23-Q4, particularly for loans exceeding INR 1 Crore, hinting at a more cautious borrowing approach.

Growth in commercial credit demand versus supply for FY 23-Q4:

Contribution of different sectors to the credit supply for ‘micro’ enterprises in FY 23-Q4:

3 Takeaways from the Blog:

- Demand-Supply Gap: While credit demand is surging, there’s a clear gap in supply, highlighting an opportunity for lenders to bridge this divide.

- PSBs at the Forefront: Public Sector Banks are playing a pivotal role in supporting ‘micro’ enterprises, reinforcing their commitment to the MSME sector.

- Cautious Borrowing: The decrease in average loan size suggests that MSMEs are becoming more prudent in their borrowing habits, possibly to mitigate risks.