India’s business environment continues to evolve, and the Indian MSME sector remains one of the strongest pillars supporting economic progress. From small neighborhood manufacturers to fast-growing service startups, MSMEs contribute significantly to employment, exports, and regional development.

Recent trends show strong growth in commercial credit demand, especially among micro enterprises. This reflects increasing entrepreneurial confidence as more individuals launch businesses using digital tools, online marketplaces, and simplified financing options. Smaller businesses are now able to scale faster thanks to easier access to loans and technology-driven operations.

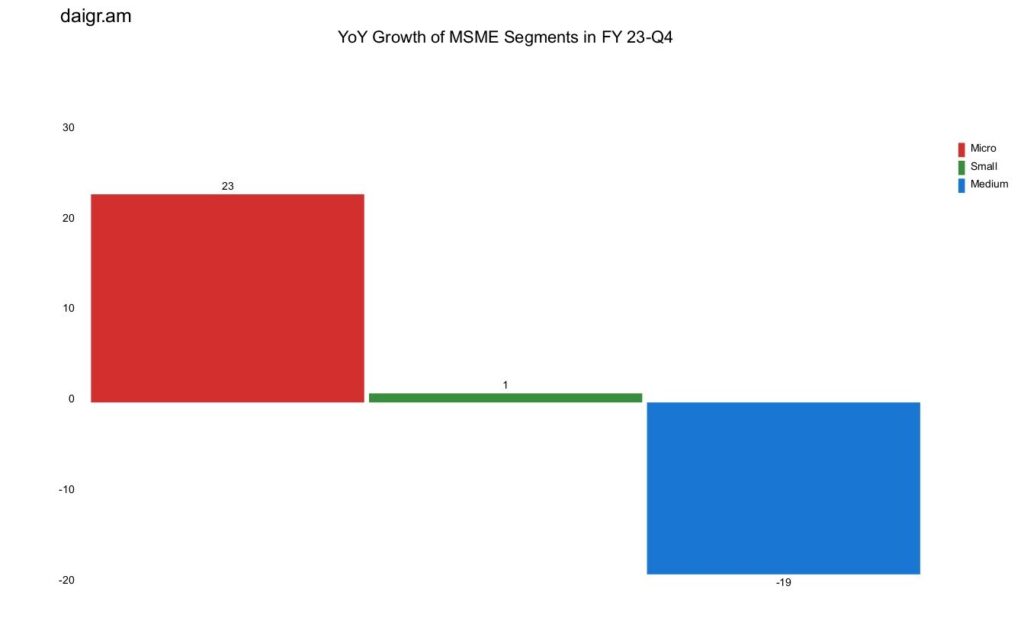

Year-over-Year (YoY) growth of the ‘micro’, ‘small’, and ‘medium’ segments in the MSME sector for FY 23-Q4:

Source – CIBIL TU

Geographic Movement

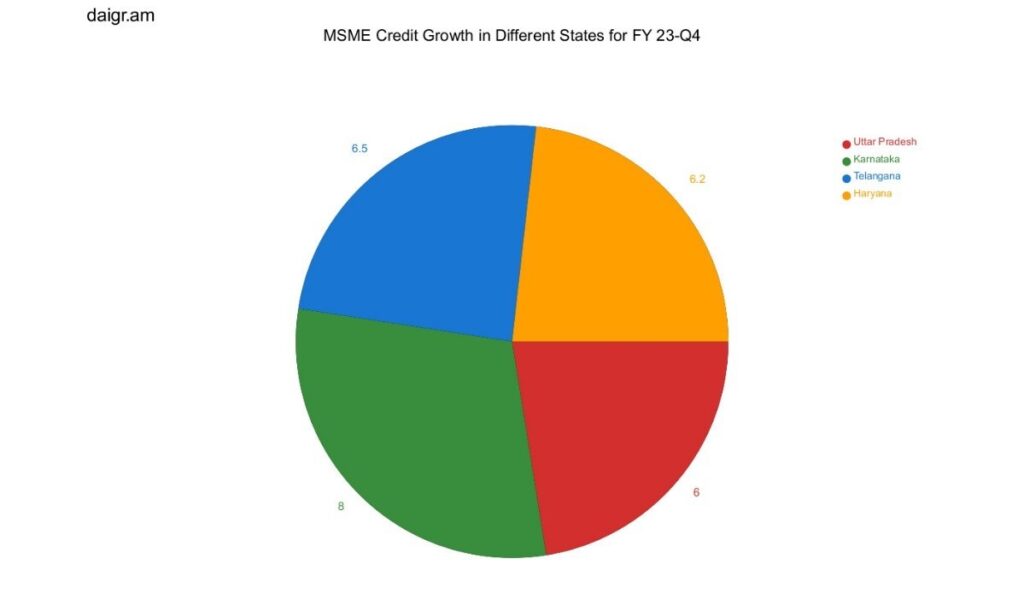

Regionally, states boasting higher industrialization levels, such as Uttar Pradesh, Karnataka, Telangana, and Haryana, have been at the forefront of MSME credit growth. Notably, Karnataka emerged as the top-performer, registering an impressive 8% growth rate.

MSME credit growth across key states for FY 23-Q4:

Source – CIBIL TU

Indian MSME Sector Growth: Expected Trends

The Indian MSME sector growth story continues to evolve as businesses adapt to new financial tools, changing markets, and digital opportunities. One key factor supporting this progress is access to smarter financing solutions like FlexiPayment, which helps small businesses manage cash flows and scale operations without financial strain.

Expected Trends in the MSME Sector

-

Continued Growth in the Micro Segment

The micro-enterprise segment continues to expand rapidly, recording strong year-on-year growth as more entrepreneurs launch small ventures. Affordable financing options and digital platforms make it easier for individuals to start businesses with lower capital requirements. Flexible payment solutions also help micro-businesses maintain steady cash flow while investing in growth opportunities. -

Revival of the Medium Segment

Although medium-sized enterprises experienced a slowdown recently, recovery is expected as economic conditions improve and supportive policies emerge. Access to flexible financing solutions like FlexiPayment allows businesses to manage operational expenses better, making expansion and modernization more achievable. -

Digital Transformation of MSMEs

Technology adoption is accelerating across the MSME sector. Businesses are increasingly using digital payments, online marketing, and e-commerce platforms to reach customers nationwide. Fintech solutions, automation tools, and flexible payment systems further empower enterprises to operate more efficiently and compete in broader markets. -

Geographical Expansion Beyond Major Hubs

While states such as Karnataka, Uttar Pradesh, Telangana, and Haryana currently lead MSME credit growth, new regions are beginning to show strong entrepreneurial activity. Local investments and supportive state policies are encouraging businesses to expand into previously untapped markets, boosting regional economic development. -

Rise of Sustainable and Green MSMEs

Sustainability is becoming an important priority for Indian businesses. MSMEs are gradually adopting environmentally responsible manufacturing practices and launching eco-friendly products. The growing green economy presents new opportunities for businesses that align with sustainability goals while maintaining profitability.

By aligning financing innovations like FlexiPayment with emerging market trends, businesses and policymakers can create a more resilient MSME ecosystem. With continued support, digital adoption, and smart financial solutions, the MSME sector will remain a vital contributor to India’s economic progress in the years ahead.

Follow for more detailed information..