MSME Credit Trends in India: Demand, Supply and Growth Insights (2023–24)

The MSME sector continues to play a critical role in India’s economic growth, contributing significantly to GDP, employment, and exports. Over the past year, MSME Credit Trends in India have shown notable shifts in borrowing behavior, credit demand, and lender participation. Analyzing these trends helps businesses, lenders, and policymakers understand where opportunities and challenges lie within MSME financing.

Rising Credit Demand Among MSMEs

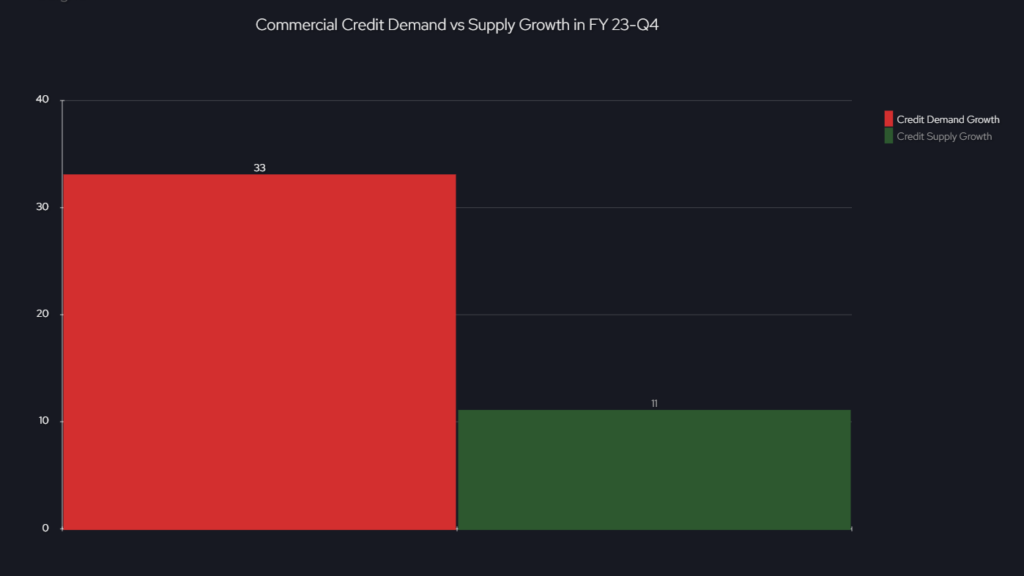

One of the most striking developments in 2023–24 has been the strong increase in credit demand from MSMEs. During FY 2023 Q4, commercial credit demand grew by approximately 33%, showing that businesses are actively seeking funds to support operations, expansion, inventory purchases, and working capital needs.

This surge reflects growing business confidence after economic recovery phases and increased business activity across manufacturing, services, and trade sectors. MSMEs are increasingly looking to formal credit channels instead of informal borrowing sources.

Growth in commercial credit demand versus supply for FY 23-Q4:

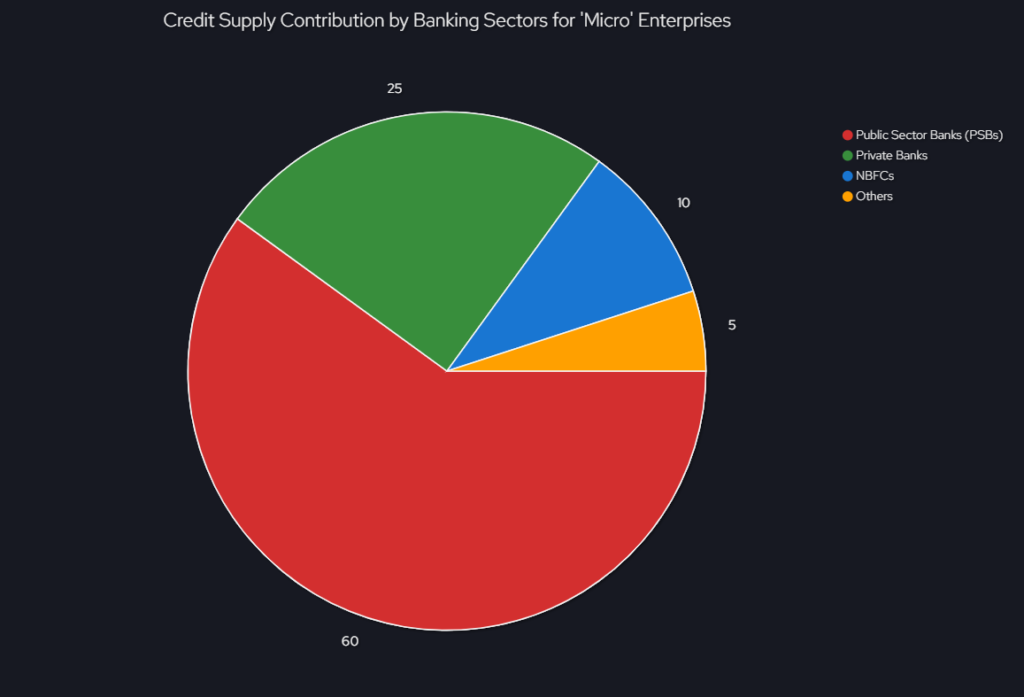

Contribution of different sectors to the credit supply for ‘micro’ enterprises in FY 23-Q4:

Credit Supply Still Trails Demand

Despite the rise in credit demand, supply has not kept pace. Credit supply grew only around 11% during the same period, creating a visible demand–supply gap.

This gap suggests that many businesses still struggle to obtain timely financing due to:

-

Risk perception around MSMEs,

-

Limited credit history for smaller businesses,

-

Collateral requirements,

-

Strict lending norms.

For financial institutions and fintech lenders, this gap presents a large opportunity to expand lending solutions, especially through technology-driven and data-backed credit assessment models.

Public Sector Banks Lead MSME Lending

Another important aspect of MSME Credit Trends in India is the continued leadership of Public Sector Banks (PSBs) in lending to small and micro enterprises. PSBs remain the primary credit providers for micro businesses, helping smaller enterprises access formal funding.

Their focus on priority sector lending and government-backed schemes has helped many small businesses gain access to credit, especially in rural and semi-urban markets.

Businesses Borrowing More Carefully

Interestingly, while demand for credit has risen, the average loan size has declined, particularly for loans above ₹1 crore. This indicates a more cautious approach from businesses.

Instead of taking large loans, many MSMEs now prefer:

-

Smaller ticket loans,

-

Short-term working capital finance,

-

Need-based borrowing,

-

Better cash flow management.

This cautious borrowing reflects lessons learned during economic uncertainties in recent years, where businesses aim to reduce debt risk while maintaining operational flexibility.

Read this : Supply Chain Finance Innovation Powered by FinTech

What These Trends Mean for MSMEs

Current MSME Credit Trends in India indicate a transition phase:

-

Businesses are growing and need more credit.

-

Credit supply still needs expansion and innovation.

-

Lending institutions have opportunities to support MSME growth.

-

MSMEs are becoming financially disciplined and strategic borrowers.

Key Takeaways

-

MSME credit demand is growing rapidly.

-

Credit supply still lags behind demand.

-

Public Sector Banks remain key lenders.

-

Businesses are borrowing cautiously and strategically.

-

Digital and fintech-led financing solutions are becoming increasingly important.

Conclusion

The MSME financing ecosystem in India is evolving. As businesses expand and modernize, access to timely and affordable credit will remain crucial. Bridging the demand–supply gap, adopting technology-driven lending, and simplifying financing processes will be key to sustaining MSME growth.

Follow for more detailed information..