What is a GST Invoice?

A GST invoice, also referred to as a bill, delineates the goods dispatched or services rendered, accompanied by the corresponding payment due.

Who needs to issue GST invoices?

If you’re a business registered under GST, you must issue GST-compliant invoices for the sale of goods and/or services. Moreover, you should receive GST invoices from your suppliers to claim Input Tax Credit.

What essential information should be on a GST invoice?

A GST invoice, typically used to apply tax and pass on the Input Tax Credit (ITC), must include these key details:

1. Invoice number

2. Invoice date

3. Customer’s name

4. Shipping and billing address

5. Customer and taxpayer’s GSTIN (if registered)

6. Place of supply

7. HSN code/ SAC code

8. Item details like description, quantity, and unit

9. Total value

10. Taxable value and any discounts

11. GST rate and amount of taxes (e.g., CGST, SGST, IGST)

12. Whether GST is payable on a reverse charge basis

13. Supplier’s signature

If the recipient isn’t registered and the value exceeds Rs. 50,000, the invoice should also include:

1. Name and address of the recipient

2. Delivery address

3. State name and state code

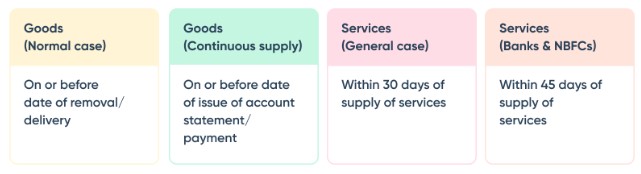

When should you send out invoices?

According to the GST Act, there are specific deadlines for issuing GST tax invoices, revised GST bills, debit notes, and credit notes. Here are the deadlines for sending out invoices:

What are the different kinds of invoices?

a. Bill of Supply

A bill of supply is much like a GST invoice but without any tax amount because the seller isn’t allowed to charge GST to the buyer. It’s used in situations where tax cannot be applied:

– The seller is vending exempted goods/services.

– The seller has chosen the composition scheme.

Invoice-cum-bill of supply

As per Notification No. 45/2017 – Central Tax dated 13th October 2017, if a registered person is selling both taxable and exempted goods/services to an unregistered person, they can issue a single “invoice-cum-bill of supply” for all such transactions.

b. Aggregate Invoice

If the total value of multiple invoices is less than Rs. 200 and the buyer is unregistered, the seller can issue a combined or bulk invoice for all these invoices on a daily basis.

For instance, if you issued three invoices in a day totaling Rs. 80, Rs. 90, and Rs. 120, you can issue a single invoice for Rs. 290, known as an aggregate invoice.

c. Reverse Charge Invoice

A taxpayer obligated to pay tax under the Reverse Charge Mechanism (RCM) must issue an invoice for goods or services received, indicating that tax is paid under RCM. Additionally, they need to issue a payment voucher when making payment to the supplier.

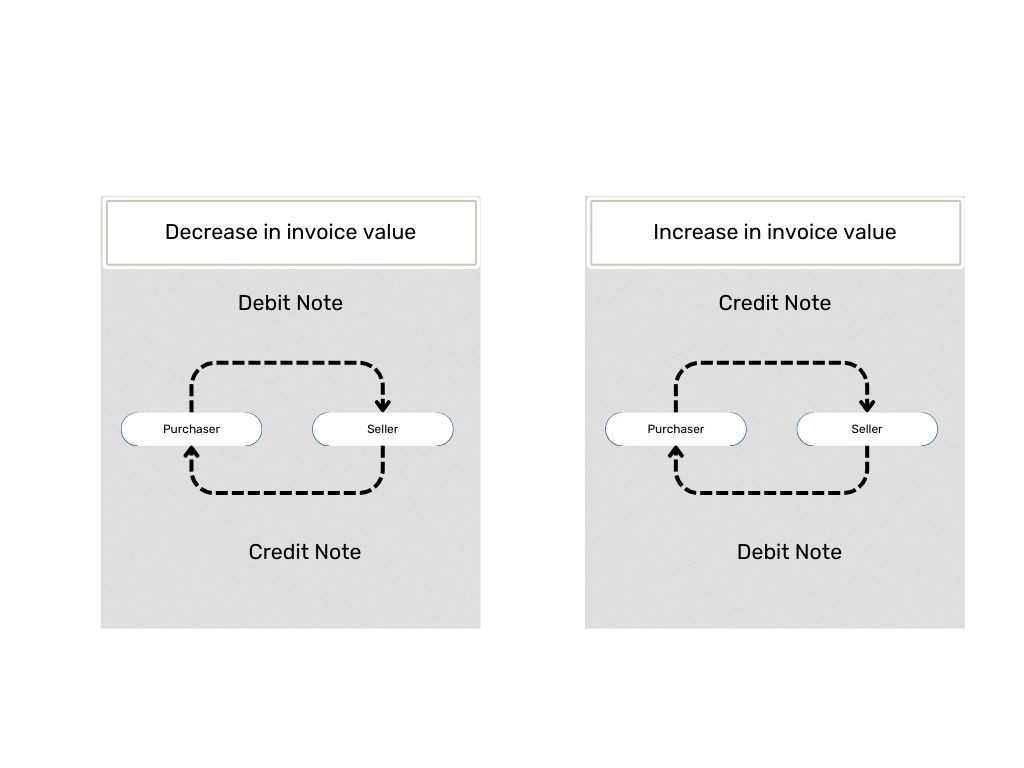

d. Debit and Credit Notes

Debit and credit notes are issued under GST in the following cases:

– Debit Note: When the amount payable by the buyer to the seller increases due to a lower taxable value or tax value on the invoice.

– Credit Note: When the value of the invoice decreases due to a higher taxable value or tax value than necessary, or if the buyer returns goods to the seller, or if the services provided are found to be deficient.

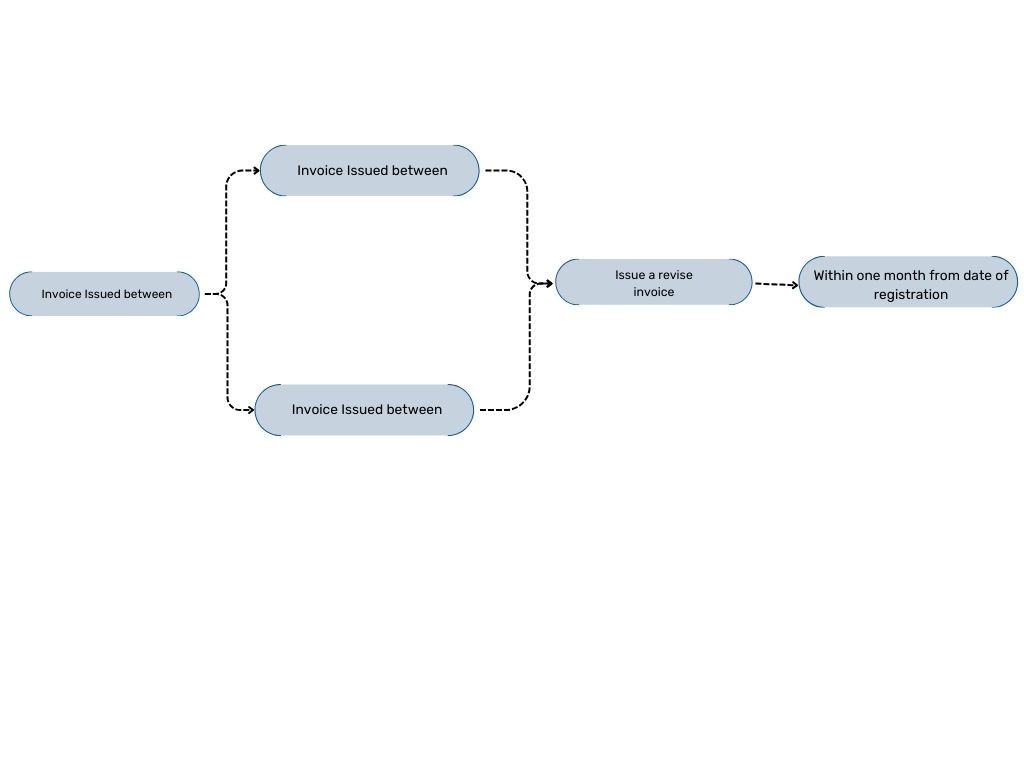

Can you make changes to invoices issued before GST?

Yes, you can make revisions to invoices issued before the GST era. Under GST rules, all dealers must apply for provisional registration before obtaining the permanent registration certificate.

The process of issuing a revised invoice is illustrated in the image below:

This rule applies to all invoices issued between the implementation date of GST and the date your registration certificate is issued.

As a dealer, you must issue a revised invoice for the invoices already issued. The revised invoice should be issued within one month from the date of receiving the registration certificate.

Are there special cases for GST invoicing?

In certain cases, such as banking and passenger transport, the government has relaxed the invoice format issued by the supplier.

How many copies of invoices should you issue?

For goods – three copies

For services – two copies

How can you customize GST invoices?

You can personalize your invoice by adding your company’s logo.

In 2020, the department introduced e-invoicing, where B2B invoices are authenticated by GSTN. This change has impacted the invoicing procedures of businesses.

What’s the difference between invoice date and due date?

Invoice date refers to the date when the invoice is created on the bill-book, while the due date is when the payment is due on the invoice.

How to issue an invoice under reverse charge?

In case of GST payable under reverse charge, you must additionally mention that tax is paid on a reverse charge, on the GST invoice.

Is it mandatory to maintain an invoice serial number?

Yes, the invoice serial number must be maintained strictly. You may change the format by providing a written intimation the GST department officer along with reasons for the same.

Can I digitally sign my invoice through DSC?

Yes, you can digitally sign invoices through DSC.