What are the tax payments required under GST?

Under the GST regime, the tax payments are primarily categorized into 3 categories :

- Integrated Goods and Services Tax (IGST) – Applicable for interstate supplies (payable to the central government).

- Central Goods and Services Tax (CGST) – Levied on intrastate supplies (payable to the central government).

- State Goods and Services Tax (SGST) – Levied on intrastate supplies (payable to the respective state government).

| CIRCUMSTANCES | CGST | SGST | IGST |

| Goods sold from Kolkata to Chennai | NO | NO | YES |

| Goods sold within Chennai | YES | YES | NO |

| Goods sold from Chennai to Bangalore | YES | YES | NO |

In addition to the aforementioned payments, dealers are obligated to make the following payments:

- Tax Deducted at Source (TDS) – TDS involves deducting tax by the dealer before making payments to the supplier.

For Example : A company hires a consulting firm for a project valued at Rs. 5 lakhs. Upon payment to the consulting firm, TDS at a rate of 2% (equivalent to Rs. 10,000) will be deducted by the company, and the remaining balance will be transferred to the consulting firm

- Tax Collected at Source (TCS) – TCS primarily applies to e-commerce aggregators. This implies that any dealer conducting sales through e-commerce platforms will receive payment after a deduction of TCS at a rate of 2%.

However, this provision is presently relaxed and will not be applicable until notified by the government.

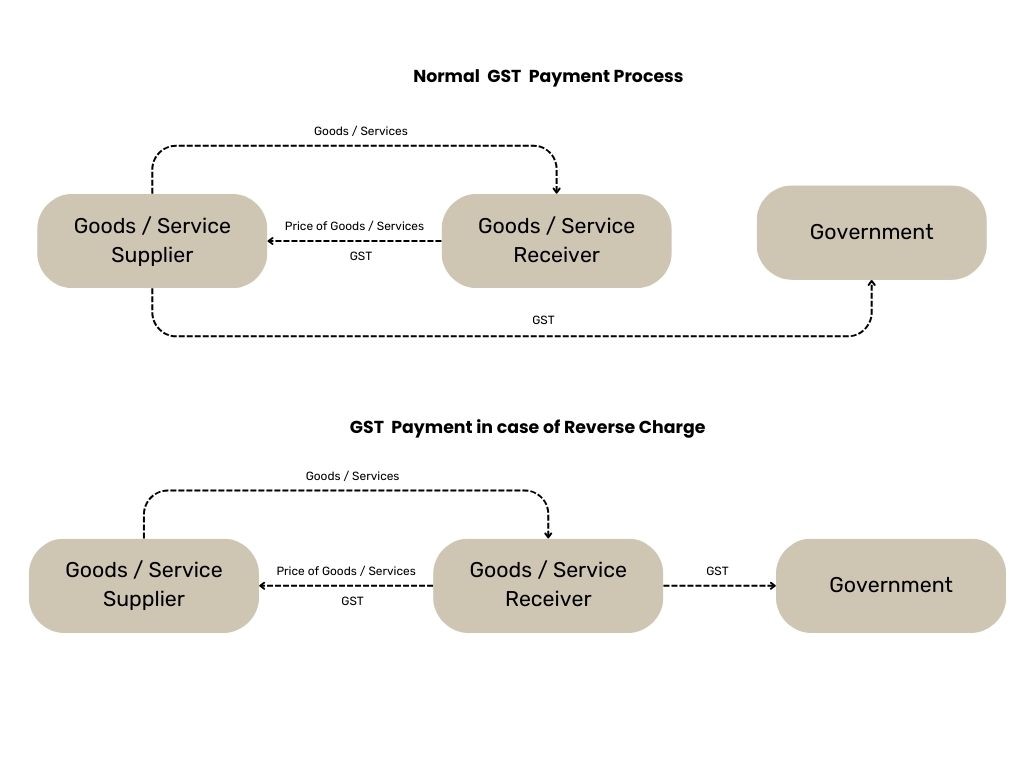

- Reverse Charge – Under reverse charge, the responsibility for tax payment shifts from the supplier of goods and services to the recipient.

- Charges such as interest, penalties, fees, and other dues.

How to Calculate the GST Payment?

Typically, the Input Tax Credit is deducted from the Outward Tax Liability to ascertain the total GST payment. The total GST is then adjusted by deducting TDS/TCS to determine the net payable amount. Any applicable interest and late fees are subsequently added to arrive at the final sum.

Furthermore, Input Tax Credit (ITC) cannot be utilized for offsetting interest and late fees, necessitating cash payments for both. The method of calculation varies for different types of dealers:

- Regular Dealer:

A regular dealer is responsible for GST payment on outward supplies and can claim Input Tax Credit (ITC) on purchases. The GST payable by a regular dealer equals the difference between the outward tax liability and the ITC.

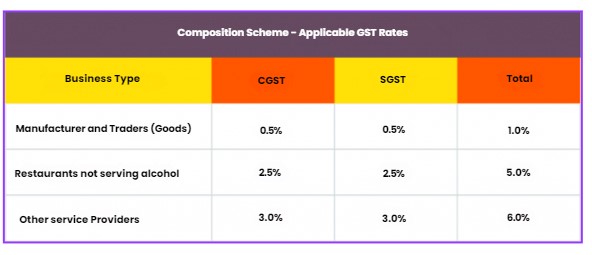

- Composition Dealer:

GST payment for a composition dealer is comparatively straightforward. Dealers who have opted for the composition scheme are required to remit a fixed percentage of GST on their total outward supplies. The GST amount to be paid depends on the nature of the composition dealer’s business.

Who is obligated to make the payment?

The following entities are mandated to make GST payments:

- A registered dealer is obliged to make GST payments if there is a GST liability.

- Registered dealers required to remit taxes under the Reverse Charge Mechanism (RCM).

- E-commerce operators are mandated to collect and remit TCS.

- Dealers required to deduct TDS.

When is GST payment due?

GST payment is required to be made upon filing GSTR-3, which is typically by the 20th of the following month.

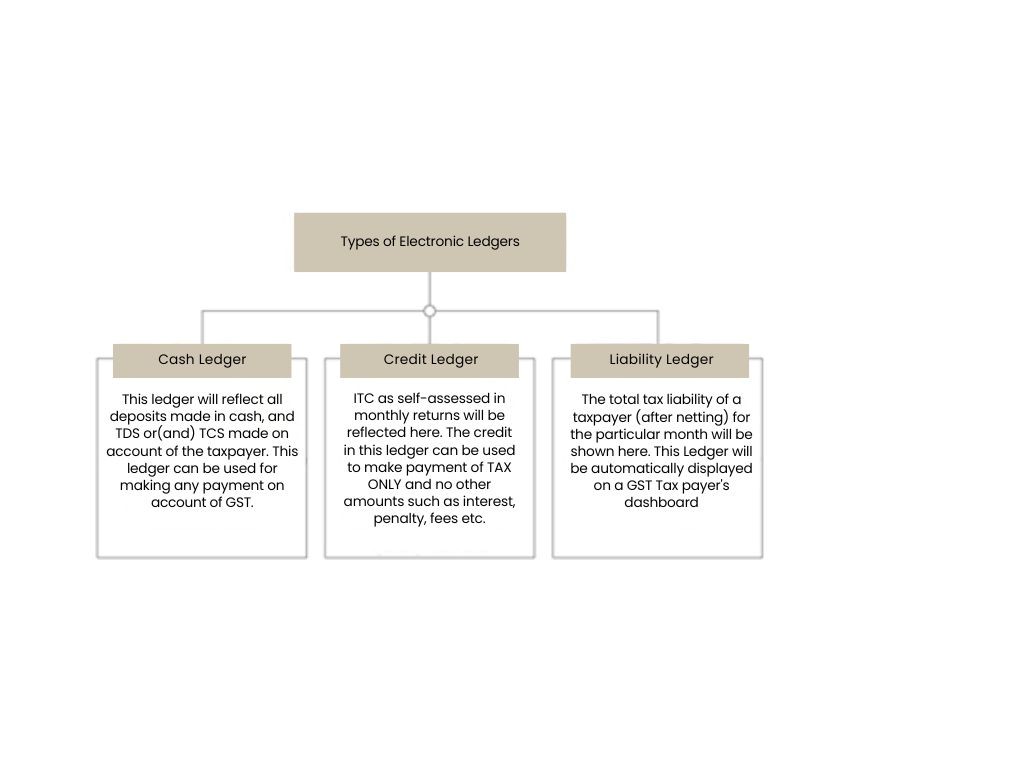

What do electronic ledgers entail?

Following ledgers are maintained electronically on GST Portal

How to make GST Payments?

There are two methods for making GST payments:

- Payment via Credit Ledger: Dealers can utilize Input Tax Credit (ITC) for GST payments, specifically for tax payments. However, ITC cannot be used to settle interest, penalty, or late fees.

- Payment via Cash Ledger: GST payments can be made either online or offline. To initiate both online and offline GST payments, a challan must be generated on the GST Portal. Online tax payment is mandatory when the tax liability exceeds Rs 10,000.

What penalty applies for non-payment or delayed payment?

In cases of underpayment, non-payment, or delayed payment of GST, dealers are liable to pay interest at a rate of 18%. Additionally, a penalty is imposed, calculated as the higher of Rs. 10,000 or 10% of the tax shortfall or unpaid amount.

What constitutes a GST refund?

A GST refund typically arises when the amount of GST paid exceeds the GST liability. The process of claiming a GST refund is standardized under GST regulations to ensure clarity and consistency. This process is conducted online, with established time limits.

When is a refund eligible?

There are various scenarios in which a GST refund can be claimed. Some of these include:

- Exportation of goods/services, including deemed exports, with a claim for rebate or refund.

- Accumulation of Input Tax Credit (ITC) resulting from tax-exempt or nil-rated outputs.

- Refund of taxes paid on purchases by Embassies or UN bodies.

- Tax refund for international tourists.

- Finalization of provisional assessments.

How to calculate GST refund?

For instance, let’s examine a simple case of tax overpayment. Suppose Ms. D’s GST liability for the month of October is Rs. 30,000. However, inadvertently, Ms. D submits Rs. 3.5 lakhs as GST payment. As a result, Ms. D has overpaid GST by Rs. 3.2 lakhs, which she is eligible to request as a refund. The window for claiming this refund extends up to 2 years from the date of payment.

What is the deadline for refund claims?

Refund claims must be submitted within 2 years from the relevant date. The relevant date varies depending on the circumstances. Here are the relevant dates for specific scenarios:

| Reason for Seeking GST Refund | Relevant Date |

| Excessive GST Payment | Date of payment |

| Exportation or Deemed Export of Goods or Services | Date of dispatch/loading/passing the frontier |

| Accumulation of Input Tax Credit due to Tax Exemption | Last day of the financial year to which the credit is applicable |

| Finalization of Provisional Assessment | Date on which tax adjustment is finalized |

Moreover, in the event of delayed refund disbursement, the government is liable to pay an interest of 24% per annum.

How to request a GST refund?

To claim a GST refund, you need to submit Form RFD 01 within 2 years from the relevant date. Additionally, the form must be certified by a Chartered Accountant.